Fixed Deposits and Bonds

Fixed Deposits (FDs) and Bonds are fixed-income options offering predictable returns. FDs provide lump-sum payouts, while Bonds offer regular interest over a set period.

Fixed Deposits: In an FD, you deposit a sum of money with a bank or financial institution for a fixed tenure. In return, you earn a predetermined interest rate, and the principal amount is returned at the end of the term. FDs are low-risk and highly liquid, making them a preferred choice for conservative investors.

Bonds: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. In exchange for your investment, you receive regular interest payments (coupon payments) and the principal amount back at maturity. Bonds are typically less volatile than stocks and are an attractive option for those seeking stable income.

What Are Sovereign Gold Bonds (SGBs) and Are They Right for You?

Sovereign Gold Bonds (SGBs) are government-backed securities issued by the Government of India, denominated in grams of gold. The government has recently promoted online purchases of SGBs.

Key Benefits of Investing in SGBs

- Tax-exempt capital gains if held until maturity

- Diversify your portfolio with a stable investment

- Government-backed, offering returns similar to gold + 2.5% interest

- Can be used as collateral for loans

- Tradable on stock exchanges

Who should consider SGBs?

SGBs are ideal for those looking to hedge against market volatility. Gold has long been a safe haven asset, and with SGBs, investors enjoy stable returns while diversifying their portfolios.

What Are Listed Non-Convertible Debentures (NCDs) and Are They Right for You?

Listed Non-Convertible Debentures (NCDs) are fixed-income securities traded on India’s major stock exchanges, BSE and NSE. These securities offer high yields, outpace inflation, and are often rated favorably, making them an attractive investment option.

Key Benefits of Investing in Listed NCDs

- Minimum investment is usually ₹10,000, making it accessible to a wide range of investors.

- Higher interest rates compared to FDs, postal savings, and similar investments.

- Liquidity is available through the secondary market for listed NCDs.

- Potential for capital appreciation, with the possibility of selling at a higher price than the initial investment.

Who Should Consider Listed NCDs?

Investors seeking alternatives to bank and corporate FDs with medium risk tolerance and those looking for regular fixed income should consider NCDs.

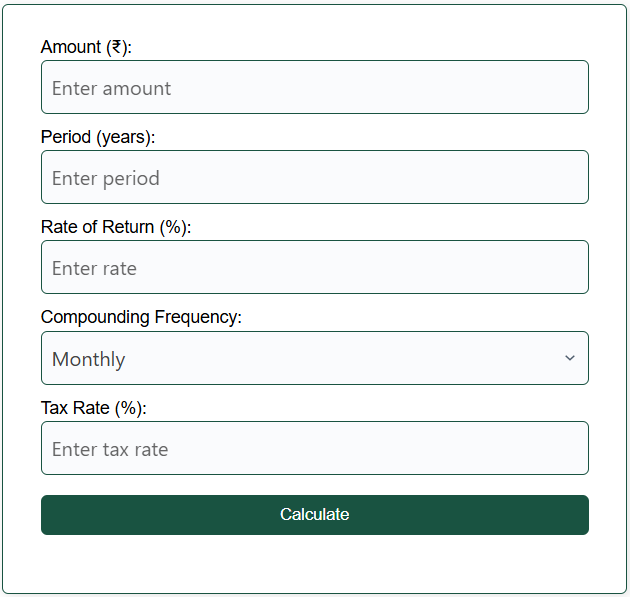

Did You Know?

A ₹1,00,000 FD at 7% interest for 5 years can grow to over ₹1,40,000!

Curious how your numbers stack up?

It’s quick, easy, and totally free.